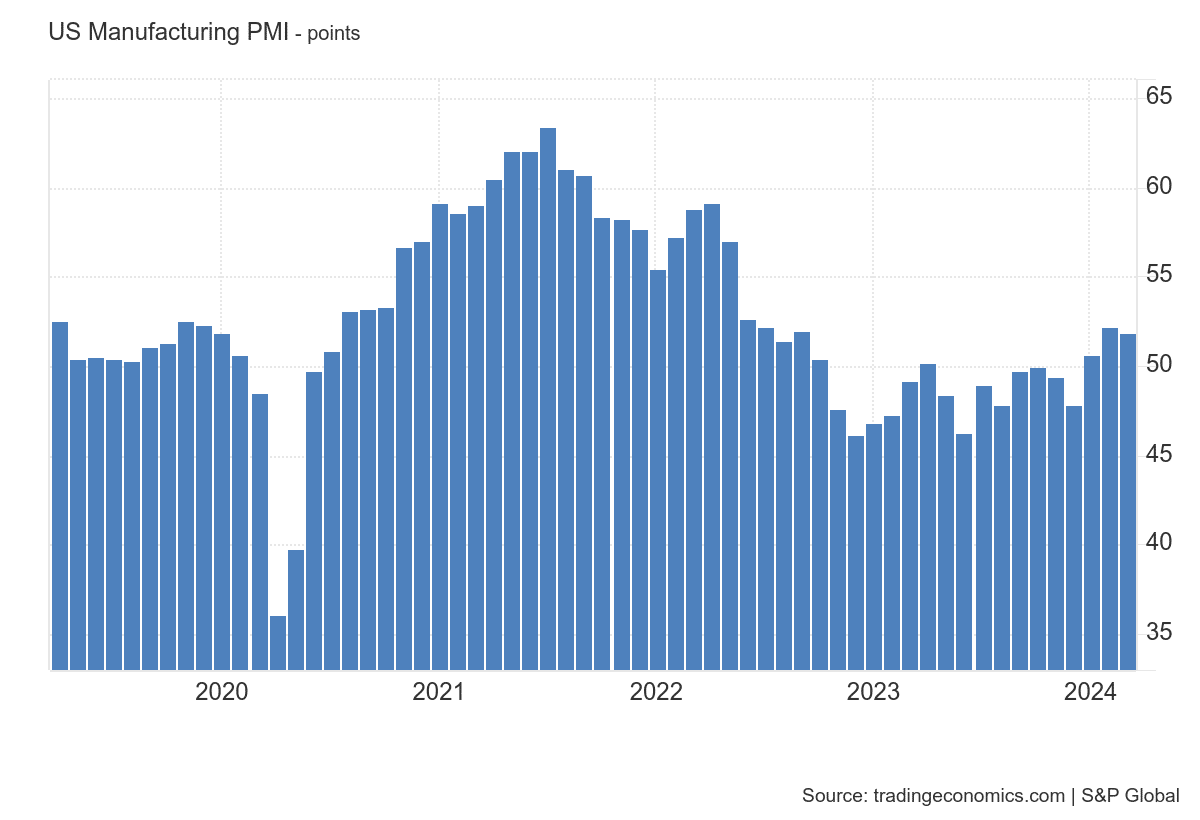

At long last, U.S. manufacturing activity is back in the black. At least, according to a major economic indicator.

Released April 1, the Institute for Supply Management’s monthly Manufacturing Purchasing Managers Index (PMI) — seen as a reliable barometer for the health of U.S. manufacturing — showed its first expansion in March in 18 months.

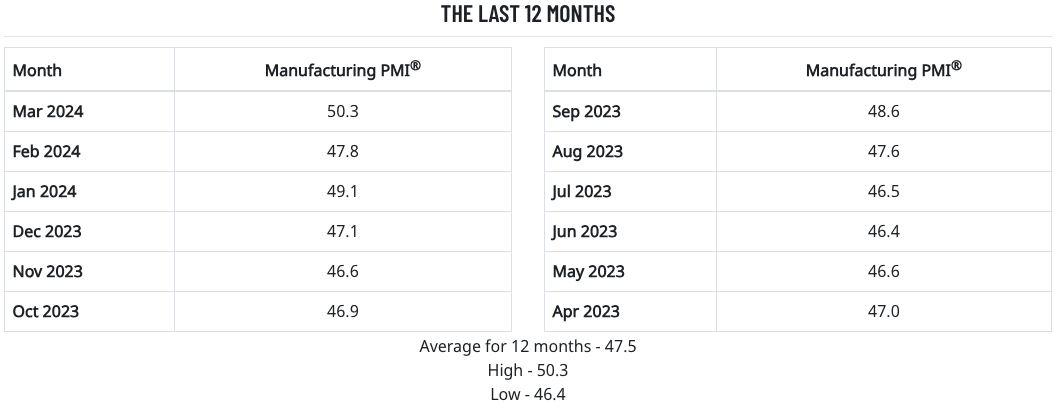

March’s PMI had a reading of 50.3%, up 2.5 percentage points from February and indicating its highest and first reading above a breakeven 50.0% since September 2022.

The positive territory month surpassed expectations, as economists surveyed by Reuters were expecting a March PMI reading of 48.5%.

Overall, the reading indicated that U.S. manufacturing moved into expansion territory during March, and at at notably faster pace than in February.

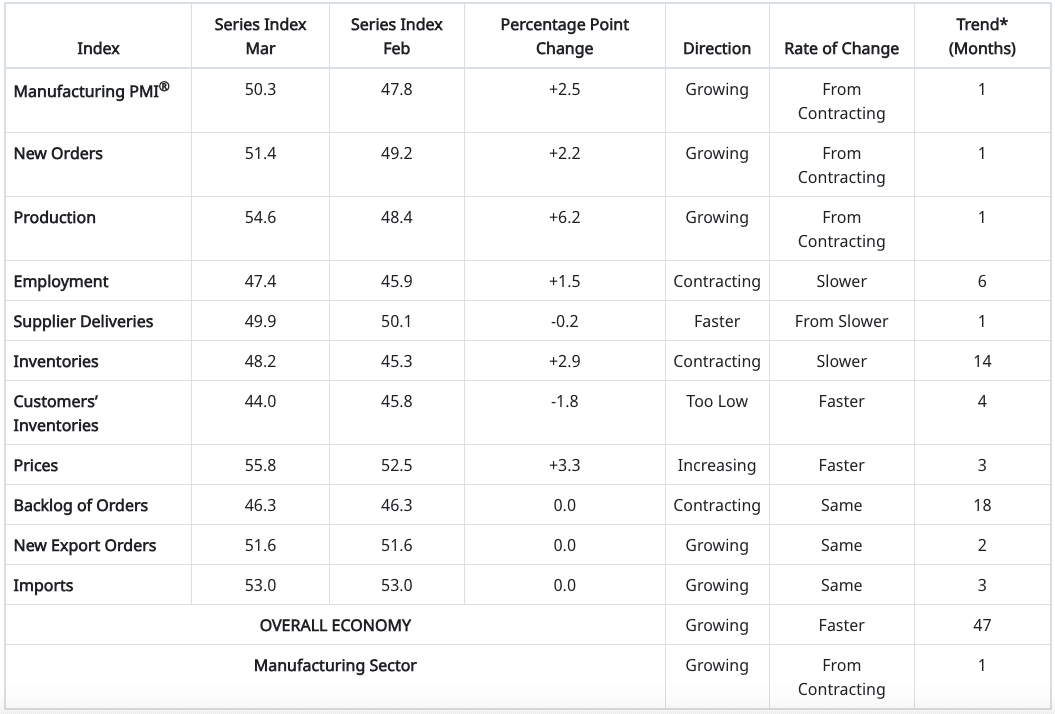

Of the PMI’s 10 factoring indices, five trended positively month-to-month in March, three were flat and only two were negative, compared to five that were negative in February. The biggest monthly moves in Production led the gains in March, jumping 6.2 points and into expansion territory at 54.6%, while prices (+3.3 to 55.8%), inventories (+2.9 to 48.2%), new orders (+2.2 to 51.4%) and employment (+1.5 to 47.4%) also had solid gains. Customer inventories decreased 1.8 points to 44.0%, while supplier deliveries — the only index that is inversed (anything above 50.0% indicates slower deliveries) — dipped 0.2 points to 49.9%. Backlog of orders (46.3%), New export orders (51.6%) and imports (53.0%) were flat.

“The U.S. manufacturing sector moved into expansion for the first time since September 2022. Demand was positive, output strengthened and inputs remained accommodative,” ISM Manufacturing Business Survey Committee Chairman Timothy Fiore commented on the March report. “Demand remains at the early stages of recovery, with clear signs of improving conditions. Production execution surged compared to January and February, as panelists’ companies reenter expansion. Suppliers continue to have capacity but are showing signs of struggling, due in large part to their raw material supply chains.”

Manufacturing at a Glance — March 2024

Of the six biggest manufacturing industries ISM tracks, four — food beverage & tobacco products; fabricated metal products; chemical products; and transportation equipment — which account for a combined 54% of manufacturing GDP, registered growth in March.

Fiore added that 30% of manufacturing GDP contracted in March, down from 40% in February. More importantly, he added, the share of sector GDP registering a composite PMI calculation at or below 45% — a reliable barometer of overall manufacturing weakness — was 1% in March, repeating February, and much healthier than the 27% recorded in January. Among the top six industries by contribution to manufacturing GDP in March, none had a PMI at or below 45%.

Nine manufacturing industries reported growth in March, up from eight in February and just four in January. Those industries were, in order: Textile mills; nonmetallic mineral products; paper products; petroleum & coal products; primary metals; food, beverage & tobacco products; fabricated metal products; chemical products; and transportation equipment.

Survey Commentary:

Here is a sampling of PMI survey respondent commentary that ISM provided for March:

- “Performance continues to defy projections of a downturn in activity. Demand remains strong, and the pipeline for orders is robust.” [Chemical Products]

- “Expecting to see orders and production pick up for the second quarter. Suppliers are working with us to help drive costs down, which will help improve the margin for the rest of the year and deliver growth in 2025.” [Transportation Equipment]

- “Commodity prices continue to hold steady.” [Food, Beverage & Tobacco Products]

- “Demand remains soft, but optimism is high that orders are ‘just on the horizon.’ Expectations are for a strong second quarter. Supply chain issues are minimal, with only semiconductors and select electronic parts being an issue.” [Computer & Electronic Products]

- “Noticing an increase in suppliers’ selectiveness regarding orders they quote and take. Additionally, there’s been a noticeable increase in manufacturing companies targeted for acquisition by larger entities (established companies, investment firms and the like).” [Machinery]

- “Business is still strong — we are meeting and exceeding our forecasts. So far, we’re not hearing anything negative with our customers as far as ongoing business is concerned — it’s the same for raw material suppliers, nothing negative.” [Fabricated Metal Products]

- “As an energy-intensive manufacturer, energy pricing continues to be a concern for our business. The move to electrification has increased demand, and supply is not stable because we’re not in an ideal geography for wind and solar power.” [Paper Products]

- “The potential aftermaths of the presidential election are beginning to impact conversations and negotiations of long-term agreements/contracts.” [Petroleum & Coal Products]

- “Continue to experience a softness in the industrial sector. There is optimism that order activity will increase in the late second quarter, leading to improvement in this segment for the second half of the year. The aerospace and defense market is continuing to ramp up, and demand is outpacing supply in our supply chain.” [Primary Metals]

- “Business activity is up. Many manufacturers are anticipating better business in the second quarter and much better in the third quarter. They are reporting that second-quarter bookings are just starting to ramp up.” [Wood Products]

Related Posts

-

The year started with a slight deceleration in industrial production following a flat December.

-

Orders bounced back from a down October for their third gain in four months.

-

It followed a sizeable jump in January, reflecting broad weakened industrial demand.