When you search for something on Amazon you are four times more likely to buy it than when searching on comparable sites. In fact, Amazon enjoys an amazing 12.9% conversion rate when customers use their search bar. Rivals, in contrast, convert only 2% to 3% of customer searches into sales. As these successful searches add up, Amazon is able to capture an extra $10 billion in annual revenue that would go unrealized with a standard search function.

Our first article in this series discussed how Amazon uses an AI-powered recommendation engine to drive tens of billions in sales. To recap, Amazon uses AI to analyze customer data and predict what items customers are most likely to buy. Unsurprisingly, Amazon’s ability to figure out what customers want without them telling it is very valuable.

But what if a customer does tell them what they want? After all, that is basically what happens when a customer uses a website search function. It is natural to think that search doesn’t matter; that when a customer starts looking for an item online, they are probably going to end up buying it no matter what. However, this idea couldn’t be more wrong. And we’ve got the data to prove it.

This article will explain how Amazon uses a highly-engineered, AI-powered engine to turn customer searches into serious revenue. It will also show that this type of technology is a natural evolution of product search technology, and a multi-billion-dollar boon for Amazon. Finally, I’ll argue that AI-backed search technology is a true necessity in today’s environment. Because here’s the bottom line: If you can’t help your customers find the items they want as well as Amazon can, then you won’t have those customers for long.

Search Technology: From the Aisle to AI

Physical businesses have been trying to aid and enhance consumer search for years. For example, grocery stores invest a huge amount of time and effort into creating physical spaces that help customers find what they are looking for and maximize revenue. However, as more and more shopping transitions to the online space, few companies have effectively applied this idea to e-commerce.

Let’s say you wanted to buy a pair of Allbirds brand sneakers online. This footwear brand specializes in making comfortable, wool shoes. It also has a specific business-to-consumer approach, and does not sell their shoes through third-party sites. So, if you search on Amazon, or Walmart, or really anywhere but the Allbirds website, you won’t actually find these shoes.

If you were looking for Allbirds at a physical store, you would head to the footwear department and look around. But, since you’re shopping online in this hypothetical, and your field of vision is only the size of a computer or phone screen, you must use the search bar to assist you.

If you search “Allbirds” on Amazon you won’t actually find Allbird sneakers, but your top results will be close matches like the Nike and New Balance equivalent of Allbirds. If you search Allbirds on Walmart however, you get nothing. Literally. All you see is a warning that no products matched your search. If you put a space in the words and search for “All Birds,” you are presented with a lovely array of bird seeds and avian themed books.

Somehow, Amazon returned relevant results, while Walmart clearly did not.

How Amazon Does it

Search relevancy is a complex science with a simple goal: Use a customer’s search input to deliver relevant results. Next, I’ll give a high-level overview of how search engines attempt to understand the meaning of your search, the relevance of possible results, and the context of the search.

You won’t need to understand all the technicalities of how Amazon has created an amazing search engine, but it will be helpful to take a quick look under the hood of this $10 billion growth hack.

The most important part of a search is actually figuring out what a customer means. But unpacking customer intent is a lot harder than it might seem. In order to work around synonyms, regionalisms and misspellings, search engines must use an advanced type of AI called Natural Language Processing (NLP).

For example, if you intend to search for “shoes,” but miss the ‘e’ key and ended up typing “shows,” Amazon will split the difference and present you with a combination of footwear and TV shows. When you do the same thing on Walmart, the site only returns a large catalog of DVDs.

But, just finding the right type of products won’t cut it. Search engines also need to find the most relevant products. In my shoe/show search, for example, Amazon presented me with a lot of highly rated and well-reviewed products. The top two options alone netted nearly 6,000 reviews, and averaged 4.6 stars out of five. The top two Walmart results, on the other hand, had just eight total reviews.

Clearly, Amazon has engineered their search to give high-quality, highly-relevant results, while their competitors are stuck with more literal, less-productive searches.

Amazon by the Numbers

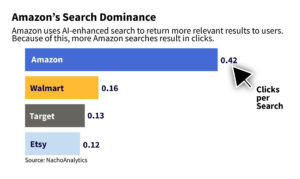

The lopsided comparison between Amazon’s search function and Walmart’s search function is not merely a qualitative matter. The data clearly prove that Amazon’s search generates much more revenue than Walmart’s, or any other competitors for that matter.

Last year, Mike Roberts, the CEO of an analytics company, published a truly shocking report on the search gap between Amazon and its competitors. This revealed that when a customer visits Amazon, they have a 2.3% chance of buying something. That is an extremely high baseline conversion rate. But, when a customer searches for something, that rate leaps up to an astounding 12.9%. This means that Amazon search increases the chance of a sale by 558%. Walmart search, on the other hand, offers just a 252% increase.

Why is Amazon so good? Well, it all comes down to the type of search relevancy we just discussed. Forty-two percent of Amazon searches result in a click. That might seem low — until you realize that only 16% of Walmart searches end in a click. Comparable sites like Etsy and Best Buy do even worse, with just 13% and 12%, respectively.

The fact that Amazon searches are literally three times more likely to end in clicks and sales is no accident. According to LinkedIn, 1,638 employees at Amazon specialize in relevance. This means that Amazon has more than 1,000 software developers and engineers researching and creating ways to improve search engine relevance. In contrast, Walmart only has 173 employees in that category. Best Buy has 34. Etsy has 16.

So, why does Amazon employ 10 times more search relevance specialists than their closest competitor? Because it is more than worth it to Amazon. If Amazon search performed like everyone else, they would convert on three-times less search sales, and miss out on nearly $800 million every month. Over a year, that means their search is worth roughly $10 billion.

Distributors can use AI to similar ends. However, they’ll need to make several B2B-specific adaptations and create a clear implementation strategy. In our most recent whitepaper, we explain exactly how distributors can do just that.

In the following weeks, I’ll offer one more article with MDM explaining Amazon’s final AI-powered secret. For more information on how distributors can leverage this technology, visit our site.

Related Posts

-

Amazon's new 820,000 square-foot site in the city of Pflugerville will create 1,000 new, full-time…

-

New 625,000 square-foot site in the city of El Paso — the second facility coming…

-

Online giant now hiring for 3,500 new tech and corporate jobs in Dallas, Detroit, Denver,…