When we think of differentiating ourselves, we often fall back on what kind of products/services we sell. But if we take a page out of Simon Sinek’s Start with Why, what we sell actually isn’t very differentiating, at least when it comes to loyalty.

You may carry more products than your competitors, expanding your ability to pull in customers. But what’s to stop your competitors from picking up those products?

No, differentiation comes instead from your people, your superior process, the experience and (most importantly) the trust you can establish with your customers. Let’s take a look at the data to back this claim up.

It’s about people

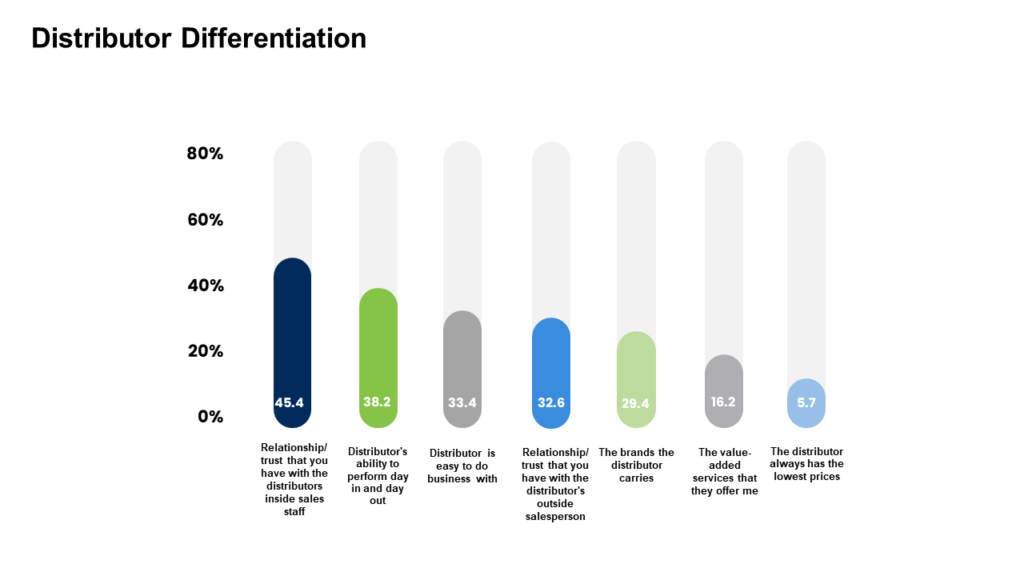

In a study HMI Performance Incentives recently conducted on contractor habits, views and preferences, we found that while contractors remain by-and-large loyal to their chosen distributors, there are certain elements that will drive them away from one distributor and toward another. These key factors, in order of importance, are: people, process, products, and, to a much lesser extent, price.

To begin, contractors consider distributor relationships to be the most important. In particular, we found that relationships with a distributor’s inside sales teams are paramount, with more than 45% of respondents indicating that this was a key driver of differentiation, compared with only 32% for outside sales teams. This seems to suggest two things:

- That despite the inevitable rise of e-commerce in the distribution space, distributors cannot neglect the role that their salespeople play in helping them stand out.

- That the inside salesperson has become the lynchpin of the contractor-distributor relationship.

Vital to this relationship is the trust that contractors feel they can place in their suppliers’ salespeople. This includes:

- Reliable business communications, potentially via SMS text messaging.

- The ability to offer personalized customer relationships.

- The knowledge that their suppliers understand the challenges they’re facing and how best to help them overcome these challenges.

This last point has been especially important for mid- to large-size contractors, who have needed speed and size to keep up with overwhelming demand over the past 18 months.

It’s also about process

The next element of distributor differentiation is process, which can roughly be broken down into day-to-day reliability and general ease of doing business. How you do business can be just as important as the people you bring on:

- On the one hand, contractors feel that if a distributor can consistently perform, can deliver what they need, when they need it, this is valuable enough to garner loyalty.

- On the other hand, contractors also want to know that the relationship with their supplier will be relatively frictionless and hassle-free, and that their interactions tend to grow in value as opposed to a series of hoops that need to be jumped through.

This is where omnichannel offerings may fit best, as they can help streamline communications, troubleshooting, delivery notifications, and the like.

It’s about a better experience

Lastly, products and services are a valuable component of the contractor customer experience. In another question we asked about why contractors are loyal to distributors, answers focused on a holistic approach to what distributors can provide their contractors. Simply put, contractors are looking for any additional value-added services that their suppliers can offer them and on-brand availability.

Value-added services go beyond things like speedy delivery. They can include:

- Training

- On-site storage capabilities

- Specialist availability

- Design services

- And more

It should be noted that product availability was hit hard during the supply crunch of the pandemic. Smaller contractors in particular have had to focus more on the basic task of securing the products needed to complete day-to-day projects.

Price does not play much of a role for contractors when it comes to choosing a supplier, as it’s shown in both questions that lowest price doesn’t seem to matter. In fact, less than 6% of contractors stated that suppliers having the lowest prices was a key differentiator for them. Though it should be noted that competitive pricing is still very important.

This suggests that price has either become a table-stakes element of the contractor-distributor relationship, or that contractors are acknowledging the unavoidable price volatility currently at play due to the pandemic. In either case, the survey results make it clear that a race to the bottom in terms of price should not be a main focus for distributors at this time.

Strong relationships, streamlined processes

Think about this from a B2C perspective. Take Amazon for example. If we didn’t trust Amazon to deliver in the expected two days, would we ever buy Amazon Prime? Or if their only excuse was logistical errors, would Amazon even be the company it is today?

Lately, it seems that everyone has been talking about e-commerce and the digitization of the customer experience. But as these tech-based strategies have steadily transitioned from innovative trends to necessary practices, it can be easy to overlook the fact that what has brought many distributors success throughout the years — strong customer relationships and streamlined processes — still is what remains most relevant today.

In fact, where distributors really stand out from Amazon is this very thing: the human relationship. In light of things like chat bots and virtual assistants that have depersonalized the customer experience, it’s the personal touches that are more important than ever.

Because ultimately, each and every one of your competitors — if they’re still around — will end up having an e-commerce site, mobile ordering, SMS messaging, etc. As savvy distributors upgrade their tech stack and digitize their customer experience, the margin for these tools as differentiators will grow slimmer and slimmer. But what seems to endure is customers’ desire to work with partners they can rely on, with people they can trust. So, if your team can find ways to stand out among the rest, and you can combine this with digitally focused, ecosystem-level upgrades, you won’t just be showing your customers that you’re different—you’ll be showing them why you’re better.

If you’re interested in downloading the full report, visit HMI Performance Incentive’s website here.

Related Posts

-

Bloomreach’s Jason Hein talks about how a good customer experience is key for both traditional…

-

Ohio-based buying group says it has added 14 new distribution members and 9 suppliers from…

-

Fischer Process Industries said it acquired Frakes-PumpWorx in part to offer an integrated service operation…