At MDM’s recent M&A Virtual Summit, Reed Anderson of Houlihan Lokey provided a blueprint for distributors looking to sell as the economy emerges from COVID-19.

During his presentation, “Post-Pandemic Considerations for Buyers and Sellers,” Anderson, the managing director for Houlihan Lokey’s Specialty Distribution practice, outlined some of the critical steps that owners should consider before putting their companies on the market.

First, he noted, M&A is going to accelerate throughout 2021 as companies look to restart deals that had stalled during the ravages of COVID. “I think activity is going to be really, really strong,” Anderson said, citing the improving economy as well as favorable equity and debt markets as reasons for the coming uptick.

Secondly, he said, it’s easy to see which businesses are well-positioned for a post-COVID potential deal. They’re the ones that made some key maneuvers during the pandemic.

“We have seen a lot of distributors embrace the chaos, embrace the challenge and find ways to make their customer relationships better and improve employee safety while also improving efficiency within their operations,” Anderson said. “The flip side of that is we have seen businesses that didn’t adapt, didn’t improve. In many cases, those businesses are, to a certain degree, getting left behind. I would encourage you, if you’re one of those businesses that hasn’t embraced the change and hasn’t thought about some of these things, that now is the time to do it. It’s not too late.”

Here’s Where to Begin

Anderson also said there’s a “fundamental shift going on in distribution, and COVID has accelerated that shift. We’re going to come out on the other side with leaner, meaner competitors in this space across all different end markets and products.”

For any company that wants to leverage that shift and sell for a favorable price in an increasingly competitive M&A landscape, the first step is to chronicle how your business navigated COVID.

“If you’re looking at potentially selling your business at some point over the next 12, 24 or 36 months, or even five years, what you ought to do is document the negative things that happened,” he said. “You’re going to forget in one year or two years everything that happened during this tornado. What were the negative things that happened? What are the positive things that you did to confront those? What have you done, internally, to make things better? Create a list. Identify those. You should keep a log of what that is because when you go to sell, you’re going to want to explain what happened during the pandemic.”

Specifically, he said, take a hard look at your numbers, including which products sold well and which ones didn’t. If your business was negatively impacted, note why you think revenue will come back when COVID has passed.

“Maybe you’ve found a more efficient way to do more with less from a cost perspective,” Anderson said. “Document what you did so that a buyer, in a year from now, who sees you thriving, can say ‘I believe that that’s sustainable,’ as opposed to thinking, ‘We need to go back to 100% of the cost that you had in 2019.’

“Those are the kinds of things, from an exit perspective. that will be incredibly helpful as you get into diligence. It will allow a buyer to gain conviction in your conviction because they’re looking at something from the outside without all the benefits of the experience that you have.”

To learn more from Anderson’s session or to watch all the presentations and panels from the daylong event, click here to sign up for on-demand registration. It will give you the tools needed to be a better dealmaker.

Related Posts

-

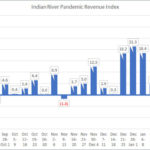

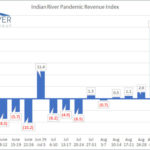

Indian River Consulting Group’s (IRCG) weekly Pandemic Revenue Index for the work week of Feb.…

-

Indian River Consulting Group’s (IRCG) weekly Pandemic Revenue Index for the work week of Feb.…

-

Indian River Consulting Group’s (IRCG) weekly Pandemic Revenue Index for the work week of Sept.…