Editor’s Note: This is the condensed, free version of the MDM Premium article by the same title. The Premium version contains deeper analysis. Not a Premium subscriber? You can change that here. See the Premium version of Part 2 here, and the condensed, free version here.

Wesco International — one of North America’s largest distributors in any channel — continues to branch out from its primary electrical market with expanded services and offerings. As a former senior leader for two businesses now a large part of the Wesco family (HD Supply Power Solutions and Anixter), I will share some personal opinions and insights on their recent major moves and initiatives as part of MDM’s distributor analysis series.

As a public company, Wesco shares the required public financials and reports and augments them with select press releases and some annual investor presentations.

We will provide additional market insights and analysis as we examine their recent major moves and strategies in this series of Premium articles that are accompanied by condensed free articles and a comprehensive report to be available in the MDM Store.

The best place to start any analysis is to look at how the business is structured.

Business Breakdown

Wesco structures its business into three divisions:

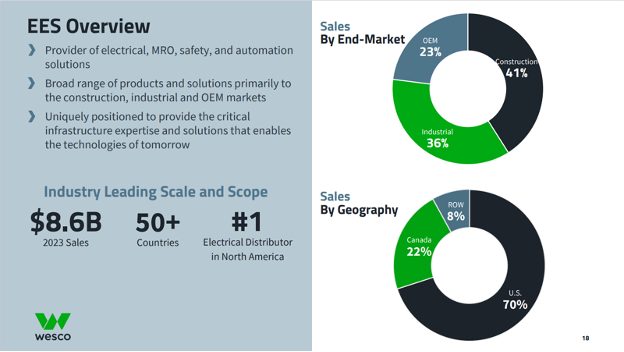

Electrical and Electronic Solutions (EES): $8.6B in 2023 Sales (38.4% of total)

I would call this segment traditional electrical distribution — selling everything from switchgear to PLCs to electrical contractors, industrials and OEMs.

Wesco has in this segment perhaps the largest number of competitors ranging from the nationals — CED, Sonepar and Rexel-types — to single-location local distributors. If you look at MDM’s ranking of the Top 30 Electrical Distributors, the majority of the business for those rankings is in the Wesco EES segment. This is U.S. wholesale distribution’s most competitive market in terms of the total number of end customers and major competitors.

In North America (where Wesco has the vast majority of its total business), I have always used an analogy that the EES market is like a broken windshield. Each local market has its own universe. For example, I have worked for electrical distributors where we were the No. 1 distributor in Orlando, but just three hours away in Jacksonville, we might be in last place. Size and scale are hard to leverage as easily as it is in other distribution channels. The market dynamics, relationships, manufacturer partnerships and alliances vary widely market-by-market across all 130+ major U.S. and Canadian markets.

This is a branch-driven environment, with locations near the end-customers carrying ample stock supported by regional distribution centers to serve customers. We will dive into these market dynamics in more detail in our full report.

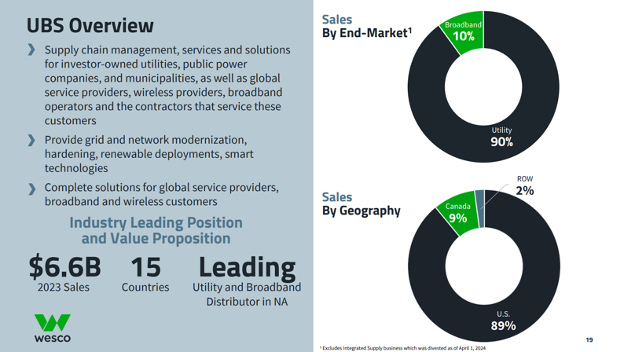

Utility and Broadband Solutions (UBS): $6.6B in 2023 sales (29.5% of total)

This unit is focused on utility and broadband, and more exclusively now that Wesco sold its Integrated Supply division to Vallen for $350 million in early 2023 That Integrated Supply component was included in this UBS unit’s 2023 figures seen above.

Wesco is the market leader in UBS in North America as it and Anixter were the 1 and 1A market leaders prior the 2020 acquisition. There is some strong competition in utility from distributors such as Border States, Dakota Supply, Irby and others like GRESCO. There are a much more limited number of competitors when compared to the EES division.

For example, I was part of a billion-dollar electrical distributor that did not participate in the utility segment. Either you are in this business or not, and most U.S. electrical distributors do the vast majority of their business in what Wesco calls EES.

There are a limited number of North American utilities that provide power. The dynamics of a limited number of large customers are also similar in the broadband market. The USB market is primarily huge customers with annual RFPs, large orders with many lines and end customers with large buying power.

This specialized business has its own channel inside electrical with different reps, manufacturers and product sets that are unique to UBS. This channel is “old school distribution” where you get out and call on a limited number of customers with experienced associates to win.

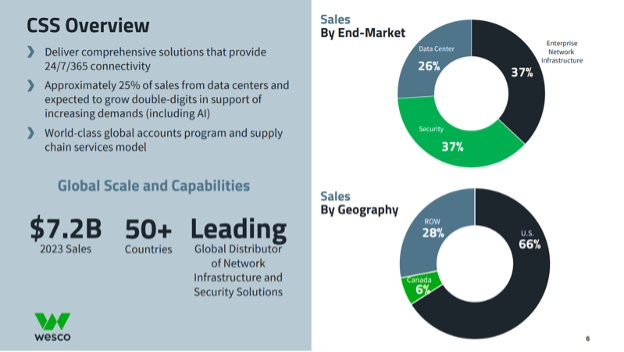

Communications and Security Solutions (CSS): $7.2B in 2023 sales (32.2% of total)

Early in my career, this business was often called Datacomm, but it has now broadened in scope to include network infrastructure, security and data centers. In this segment there are more limited competitors in this space most notably Graybar and ADI.

To serve this market it requires highly technical associates with line access being critical and more constrained in the channel

Major manufacturers with highly-integrated CSS solutions often have strategic distribution where the end customer has a limited number of distributors with proper franchise agreements to serve them. The market dynamics of limited distribution (when compared to EES) and a smaller number of contractors and end customers to serve is a recipe for a profitable business.

The Takeaways from Wesco

So, what can you learn from Wesco’s business breakdown and what does it mean to you as distributor or manufacturer?

Smart Silos and Business Segmentation Work

Each of the markets that Wesco serves — EES, UBS and CSS — are unique. There are clear differences between each division — different margins, suppliers, number of competitors, direct versus stock sales mix, end users and more.

You might be tempted to look at these businesses as “siloed” and recommend that these silos be broken down to create synergies between like sales teams selling across all three divisions. Outside of backroom accounts payable/receivable, IT systems, etc., the commonalities might be very limited, and a one-size-fits-all business model for a sales organization will likely not work.

If your distribution channel business has long-standing silos that you are considering breaking down, it might be wise to as Wesco does, proceed cautiously in breaking down silos.

Focus on Strengths and Expand Your Core Business Selectively

Since the Anixter deal (almost all the pre-acquisition Anixter business was already segmented as EES, UBS and CSS), Wesco has been very selective in acquiring businesses.

The Integrated Supply unit was part of UBS that was sold to Vallen is a different business model than utility and broadband. The Integrated Supply business I viewed as a fourth silo that they had to focus energy and resources on, and they now have exited that business.

These two takeaways can apply to just about any distributor’s and manufacturer’s channel business.

More to Come

In Parts 2 and 3 of our Wesco series, I will cover the company’s second and third strategic pillars: “Further develop our team and our culture of excellence” and “Digitalize and transform our B2B business.” The insights from this series and more will be packaged into a report to be available in the MDM Store.

See the Premium version of this article for much more analysis on Wesco’s scale and value proposition.

Related Posts

-

Wesco signed a five-year contract with an intelligent pricing specialist company to centralize its pricing.

-

The distributor has made $200,000 in scholarships available for students entering skilled trades in the…

-

Wesco said it has already met one of its key 2030 ESG goals, and is…