Editor’s Note: This is the condensed, free version of the MDM Premium article by the same title — the third in a three-part series. You’ll find deeper analysis in the Premium version. It will appear in our July Premium Monthly report, which can be purchased from the MDM Store in August, along with a comprehensive report. See the free version of Part 1 here (and Premium here), and see the free version of Part 2 here (and Premium here).

This week, many MDM readers asked for a deeper review of Wesco International’s effort to digitize and transform their business, so we have created a deeper view as the third and final part of our series. Make sure to check out Part 1 and Part 2 if you haven’t yet, which focused on the electrical distributor’s scale and value proposition, and enterprise strategies, respectively.

After this, stay tuned for a comprehensive MDM report that packages the insights from this series and more.

Digital Intentionality

As we have discussed in this series so far, the channels Wesco serves are complex. The electrical (EES), datacomm (CSS) and utility (UBS) channels each have millions of unique SKUs the company sells with very complex part numbers.

So, how does Wesco tackle this challenge? As a public company, Wesco does not release specific how-to roadmaps to follow, but there is enough public information available to piece together what its “digital and AI journey” is focusing on today.

Wesco has been very clear that it is using digital to drive a competitive advantage.

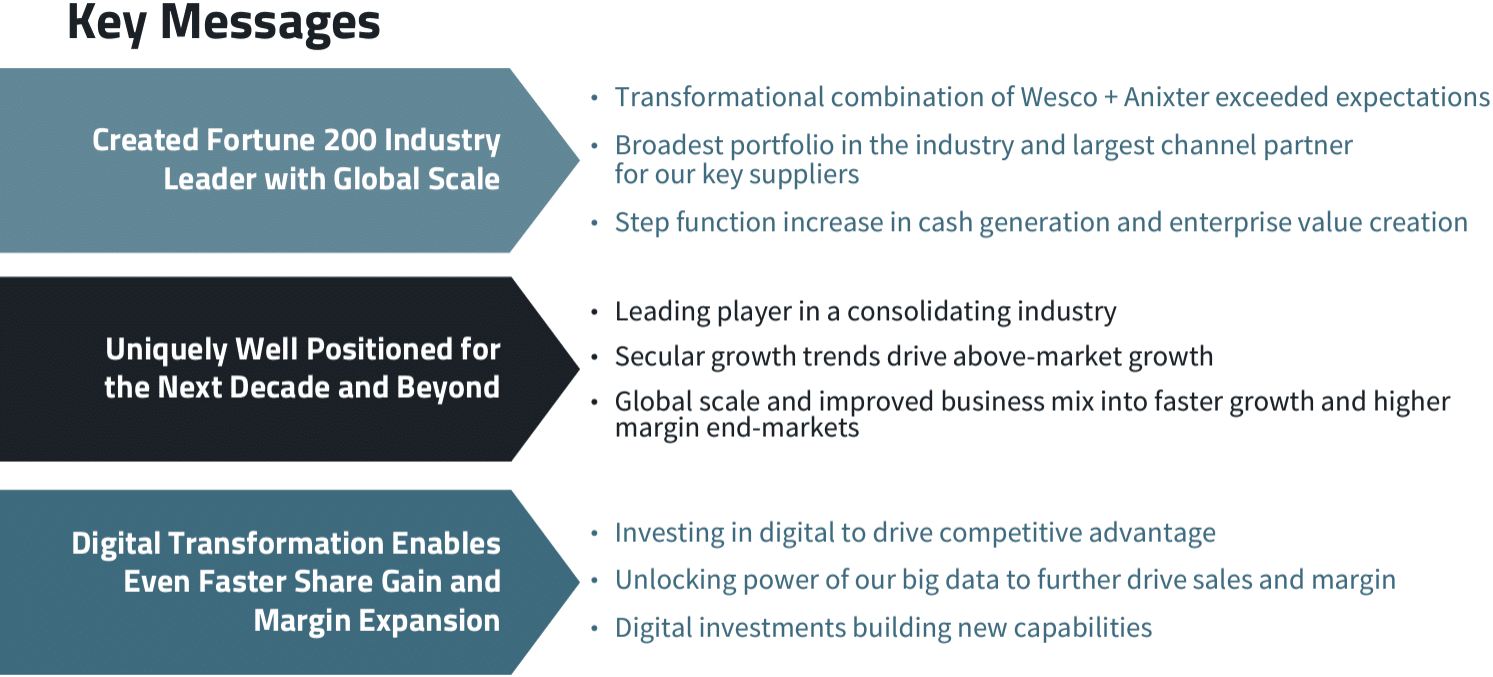

The Wesco digital graphic from its presentation during the March 2024 Raymond James Institutional Investors Conference makes it clear that investing in digital transformation is a key foundational strategy for the company.

Investing in Digital to Drive Competitive Advantage

If you listen to a Wesco quarterly earnings call, you will hear extensive commentary and questions from analysts on how the company manages its SG&A costs. The “people costs” are the main driver of SG&A expenses. So, how can data help the organization with SG&A?

Akash Khurana — Wesco’s Executive Vice President, Chief Information Officer and Chief Digital Officer — recently shared in a Wall Street Journal video with Infosys:

“It’s been 3 years since Wesco and Anixter (International) came together. We saw that as an opportunity to double down on digital transformation. We tapped into the legacy and the deep knowledge that Wesco has on this industry and built that capability into digital offerings.”

Infosys VP Vijay Narayan shared that the “Data backbone for companies like Wesco is critical because there are so many data sets.” He added that “Infosys is helping Wesco in multiple areas, and it goes across the entirety of their stack.”

What are the potential advantages of better data for Wesco? I’ve created a short list of just a few:

Ensuring the right part number for the order. Better data = fewer mistakes and better customer service than the competition.

Increased efficiency in finding the right product. This applies to both customers and associates. Less time writing the order = more time to service the customer and sell.

Increased value in Wesco’s website. Better data could make Wesco.com be the place to get data online for submittals and product information. Becoming the go-to source to get the right product specs and data to fulfill this important function has value.

Each of these data benefits will create faster and more accurate orders and a better customer experience. In buzzword-speak, this improved “customer experience” should be a competitive advantage.

Unlocking Big Data’s Power to Increase Sales and Margin

How can big data further unlock sales and margin?

I’ll share a common scenario. XYZ contractor has earned/or has the inside track on a big project for which Wesco and probably four to five other competitors in the same market gave them a package bid. More often than not, Wesco has better data, more accurate bid info and makes fewer mistakes than the competitor. Who is best positioned to win the order in the event of a tie? In this case, probably Wesco.

Our comprehensive final report will add more detail on how big data can be a key driver of above-market sales and margin growth.

As I compared public case studies from additional service providers against recent Wesco case studies, I found multiple other areas where it appears the company is investing in digital automation. This digital improvement of manual processes for both employees and end customers includes:

- Automating Cash Application — which helps Wesco process payments faster

- Touchless dunning — which improves the credit decision-making process and receivables

- Quotations Automation — which reduces the time to do takeoffs for lighting and gear from plans. I can share from experience that the old way — doing the takeoff yourself by hand — is a difficult and time-consuming process.

The Wesco Digital Transformation Approach

So, what can you learn from Wesco to apply to your distribution business?

Wesco’s digital automation strategy targets non-high value tasks and automates them for the business. The company appears to be wisely attacking this by business function and has a digital workstream for accounts receivable/payable, quotations and inventory management (and probably much more).

The Wesco digital transformation process is creating:

- More time selling vs. performing customer service functions

- More time to invest in delighting customers

- Improved cash flow

- Higher success in winning quotes

- An improved data backbone to improve product search and the customer experience

- Optimized inventory to better serve end-customers while improving their cash flow

The Final Word

Wesco is striving to smartly transform its business by function anywhere it can to create a competitive advantage and superior end customer experience.

Are you doing the same for your distribution business or channel?

Related Posts

-

The third and final part of this MDM Premium series provides a deep dive Wesco’s…

-

Here's the condensed, free version of the first in a three-part Premium series that examines…

-

The first in this three-part Premium series examines the state of electrical supplies distributor Wesco…