It’s peak sales season in distribution. The holidays are over, the weather is soon to improve, your customers are through their year-end close out and budget work.

Your 2020 sales targets are set, and although the economy may be slowing, you feel you can just take share to make up the difference. You probably have the same sales plan as you have had the last 10 years: experienced account managers, backed by an a seasoned inside team.

It’s time to energize the team and release the hounds (your outside sales team) to grow your business. But before you do, this might be the year to look at your sales coverage model first.

Let’s run a few numbers together for a fictious distributor.

MDM Supply in Denver, Colorado (8 locations)

MDM had 5,000 active purchasing accounts that provided $100 million in sales in 2019. MDM covers their territory with 20 outside Account Managers (AM) and the average account package for each salesperson is 50 accounts.

The sales team is experienced, knowledgeable and, although leadership knows they can only proactively cover 25 of the 50 accounts they are calling on, they pay them 15% of the gross margin dollars in commission to their sales teams on all their assigned accounts.

MDM Supply also has a counter business where they handle credit card orders. They really don’t know how many unidentified customers make up that business, but their “MDM CASH Account” business volume makes them a Top 25 account for each location.

The average B2B distributor follows the 80/20 rule sales coverage plan assuming that 80% of sales are coming from 20% of their customers

MDM Supply Sales follows the 92/8 model where 92% of their business comes from their top 20% of accounts. Most U.S. B2B distributors have a similar 90/10% model when it comes to annual revenue.

This is the same plan they have used to grow modestly YOY for decades, but they could be missing opportunities.

Here are some common potential missed growth opportunities.

AM Assigned “Reactive” Accounts

The average account manager at MDM Electrical has 25 accounts they have time to proactively call on, and 25 accounts that they service when they call or email the account manager or branch. I am sure they would call on these “reactive” accounts if they had the time, but they rarely do. You pay the same 15% on the proactive calls as you do on the reactive “alright I just got a surprise” orders.

Also see: “Why Distributors are Revamping Their Sales Coverage Plans.”

Recently, I was talking with a 30-year district manager (with whom I grew up in the distribution business) and we were discussing the 50-account package his account managers had. He knew he was missing an opportunity to grow the 25 reactive accounts, but the fear of change was holding him back. “I have no choice but to pay them for that business, or I might lose them to a competitor,” he said.

That decision very well may be the smart choice, but the chances of growing accounts you don’t actually call on are slim, as usually someone else is calling on them or they are buying online.

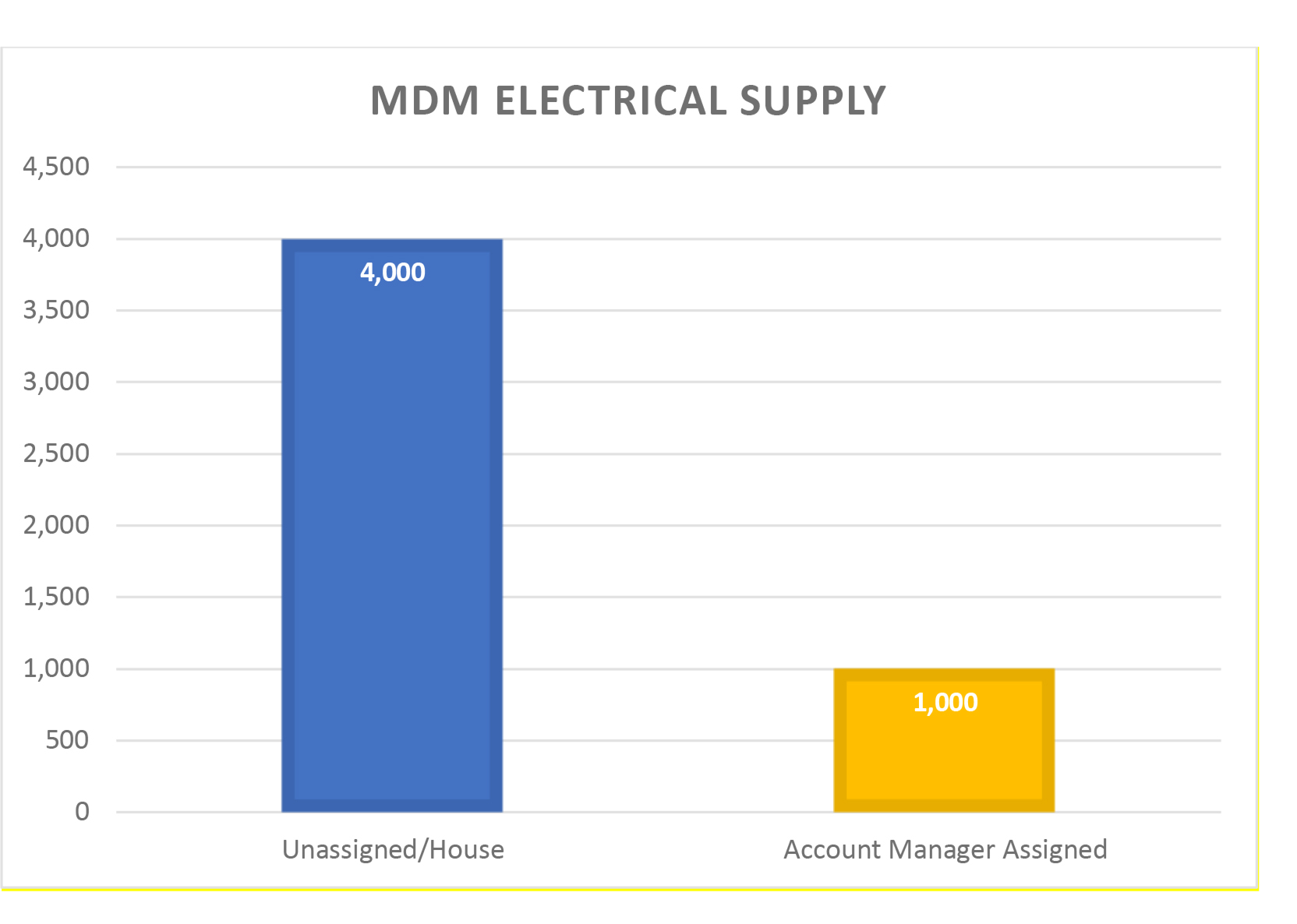

Unassigned/House Accounts

In this example, MDM has 4,000 unassigned house accounts (not including the unknown number of accounts that make up their CASH counter business). Most of these accounts do not have the total available business to ever warrant being assigned to an account manager, but many of these accounts have potential to be much larger accounts.

The MDM average assigned AM account ($92,000,000/1,000) is worth $92,000 annually.

If even as few as 3% of the unassigned accounts could reach the average that would be a significant sales increase for 2020. (4,000 x 3% = 120 accounts x $92,000.00 = $11,040,000.00)

CASH/Unidentified Accounts

Cash accounts are often set up to take a credit card transaction for smaller counter accounts, or accounts who don’t have the backing to be put on terms by your credit department.

This convenience approach put in place for the distributor to make it easier for them can hide business growth opportunities. Distributors who tie the transaction to an actual account and then market to these former CASH accounts digitally can grow this business significantly. Plus, some of these “acorns” really do grow their business and turn into oak trees.

I have consistently found at all the distributors I have worked for, and that we work with today at MDM Analytics, that there are huge growth opportunities in Unassigned and CASH accounts.

Every distributor has some mix of accounts they are proactively calling on (in-person or by an inside team) and those that they could grow by moving from reactive to a proactive sales program.

What choices can you make in 2020 to improve your sales coverage plan?

Here are just a few options:

- Create a business development inside team that proactively contacts the assigned and unassigned accounts that you don’t have the resources to call on in person.

- Build marketing communication programs and offers to unassigned accounts that drive orders on your website or calls to your sales teams.

- Tweak your commission plans to incent to your account managers on growth behaviors. e.g. Is it time to pay a sliding commission percentage based on GM% of the order?

There isn’t a straight-line answer for any of these questions since your distribution business, product mix and market position are unique to you. I recommend the best way to make the best decision for your business is to do the analysis and network with other distributors who are facing the same challenges.

Our 4th annual MDM Sales GPS conference is all about networking with distributors and manufacturers who are revamping or improving their sales coverage plans. For a couple of days, everything we do is about helping you improve sales (AM, Inside and digital). See some great case studies and talk about ways to improve your sales coverage plans with industry leaders and distributors and manufacturers who like you are planning to grow in 2020.

I hope to see you in Chicago.

John Gunderson is VP Analytics & EBusiness of Modern Distribution Management – Prior to joining MDM in 2018, John was a senior leader for 20 years leading sales, marketing, pricing, analytics, and ebusiness with companies such as Crescent Electric Supply Company, HD Supply Power Solutions, HD Supply C&I White Cap, Anixter, and EIS-INC a Genuine Parts company.

John Gunderson is VP Analytics & EBusiness of Modern Distribution Management – Prior to joining MDM in 2018, John was a senior leader for 20 years leading sales, marketing, pricing, analytics, and ebusiness with companies such as Crescent Electric Supply Company, HD Supply Power Solutions, HD Supply C&I White Cap, Anixter, and EIS-INC a Genuine Parts company.