Recently, I took a trip to the Grand Canyon, a magnificent part of our country. It looked exactly the same as I remember it from a childhood visit — with the Colorado River running through the canyon more than a mile deep below the rim. And yet at some point, millions of years ago, there was no canyon, and this river actually ran directly across the top of what used to be the Colorado Plateau. Even as an adult, I’m amazed at the thought that through the incredible power of erosion, a simple river has carved out one of the most spectacular and immense geological features in the world.

What is channel erosion?

The key ingredient here has been, of course, time, and in geology you need a lot of it to understand how the earth changes. However, other instances of erosion — say, those that occur in the world of business — typically work at much faster rates. Profit margins erode as products or services become commoditized, not over the course of millennia, but often in the span of a couple decades or even years.

Market share erodes for leading incumbents as new upstarts with more efficient business models or better technology enter the market. While this erosion can be slow and gradual — as with Kodak and digital cameras — it can also accelerate quickly and be quite dramatic. For example, Netflix was founded in 1997, went public in 2002, and within eight years it had eroded Blockbuster’s $5-billion market cap down to just $55 million — a nearly 99% decline.

So, when we talk about erosion, we’re really referring to three key elements:

- Long-term declines

- Acceleration with time

- Trends that tend to reflect permanent changes in business conditions.

This process can occur in any industry and affect almost any facet, but one area in particular where we’ve been seeing erosion occur is among distribution channels. In this channel erosion, traditional distributors are seeing their customers find alternative means of purchasing products, be it through retailers, online-only resellers, or direct from manufacturers.

As a result of these new channel “tributaries,” distributors have begun to see both their customers’ mindshare and share of wallet decrease as customers adjust to different, often more convenient modes of obtaining product.

Channel erosion by the numbers

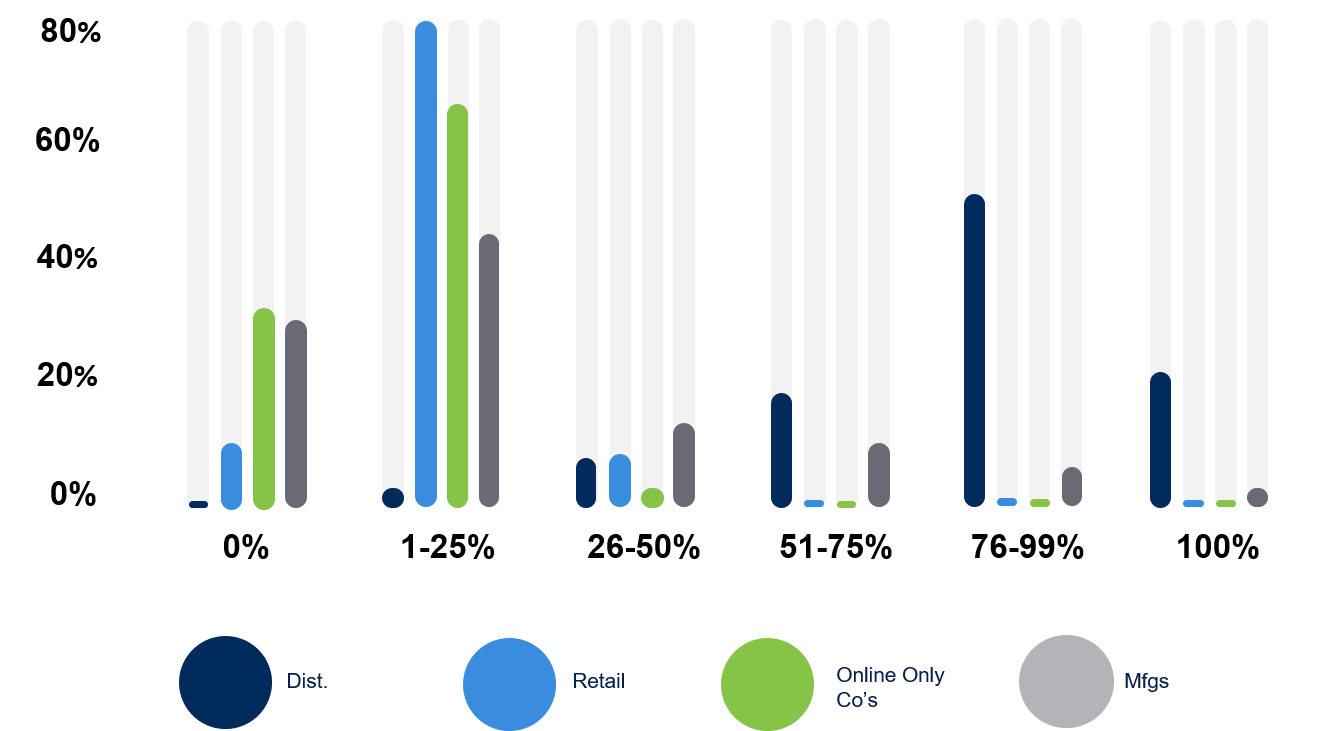

So how bad has channel erosion become? Research recently conducted by HMI Performance Incentives reveals some interesting findings. As shown in the chart below.

- While distributors still control the majority of contractor spend (roughly 72%), this number is slowly eroding. In today’s environment, less than 20% of contractors are making purchases exclusively through distributors, so the question is, where are the rest of their dollars going?

- While the amount of purchases may still be small, retail and online-only suppliers are increasingly taking share of wallet. More than 90% of contractors now make purchases through retailers like Home Depot and Lowes, while at least 66% are now purchasing at least some materials from online-only suppliers like Amazon, SupplyHouse and Zoro.

- Perhaps more alarming, though, is that nearly 30% of contractors now make at least half of their purchases directly from manufacturers, effectively cutting out the distributor “middle-men.”

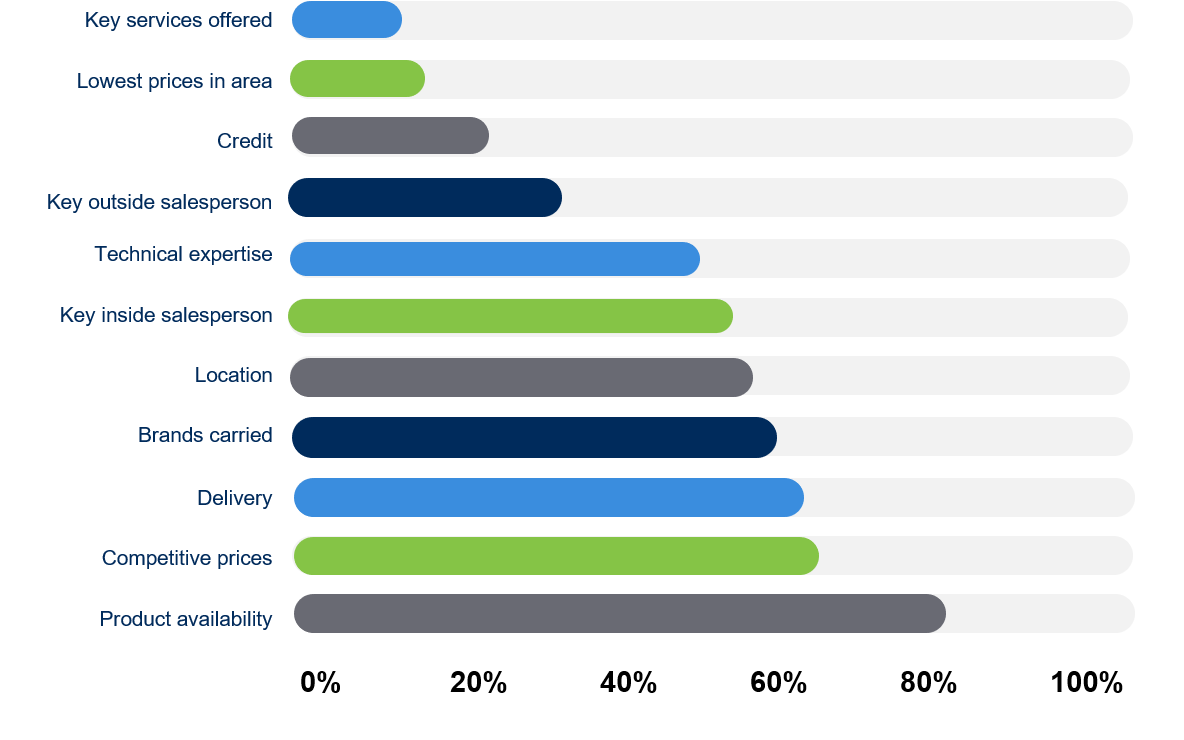

This trend toward omni-channel purchasing is not new to the building materials space, but it seems that like many things, the pandemic has accelerated it, in part because inflation and supply constraints have forced these contractors to buy products wherever they can find them. In fact, of the top five reasons given by contractors for remaining loyal to distributors, four of these (product availability, delivery, brands carried, location) involve logistics and availability.

This indicates that as the overall environment has become more challenging, contractors are seeking a purchasing experience that is simpler and easier. As shown by the chart below.

This also suggests that in a time of crisis and disruption, the traditional distribution channel wasn’t always able to satisfy the needs of contractor customers, and as a result, these customers have been forced to look elsewhere. Based on this behavioral data, it’s not a stretch to imagine that as contractors become accustomed to the benefits of this omni-channel experience, their new habits will only become more engrained.

Research by McKinsey into the feelings of B2B decision-makers would seem to support this, as it found that “even as in-person engagement reemerged as an option, buyers made clear they prefer a cross-channel mix, choosing in-person, remote, and digital self-service interactions in equal measure.”

So, should I be worried?

Should traditional distributors be worried about this data? Yes and no. On the one hand, the omni-channel expectations of customers across the board continue to grow — this has been true in the consumer space for some time, and as we’ve learned, B2B trends tend to follow those of B2C. This means that traditional distributors who lack a strong digital presence and limited omni-channel services can expect to find their market share, mindshare and share of wallet all continue to remain under pressure.

On the other hand, this changing dynamic provides opportunities for those distributors who are ready and willing to innovate to slow and even reverse the erosion their channel is experiencing. By investing in features like multi-channel communication services where customers can receive text updates from inside sales reps, and robust e-commerce platforms with self-service capabilities, distributors can ride the wave of digital innovation rather than succumb to it. Based on the data, these components are becoming table stakes for customers, and those distributors that are able to recognize this — that can identify tables stakes from value-adds — and adapt accordingly will be the ones who are best positioned to take advantage of these changes moving forward.

Lincoln Smith has more than 20 years of experience designing performance incentive programs for manufacturers, distributors and service partners to help drive share-of-wallet spend, build loyalty and increase engagement. He is a certified Incentive Professional (IP) by the Incentive Marketing Association (IMA) and serves on the Incentive & Engagement Solutions Providers (IESP) Board. Prior to joining HMI Performance Incentives, Smith worked as a strategist for Agency.com helping organizations transition to digital business models. Reach him on LinkedIn. And for more insights into contractor buying behaviors, download the full report.

Related Posts

-

Greenfield locations will play a key role in SRS Distribution’s expansion plans in 2021.

-

The Texas-based building products distributor will distribute the money to more than 4,300 of its…

-

Industrial distributor is bringing a 142,000-square-foot DC to Newtown, Connecticut, in the first half of…