Both macro-economic and industry-specific reports during the past month show that wholesale distribution has emerged from the worst of the coronavirus crisis that raged during the past 18 months.

MDM’s recent reporting shows much-needed improvement, although gains could be threatened in the coming weeks and months as the country deals with more COVID cases plus natural disasters like Hurricane Ida slamming into the Gulf Coast.

Here’s a roundup of the upbeat data to come from various government agencies and industry associations.

According to the U.S. Census Bureau, the international trade deficit was $86.4 billion in July, down $5.7 billion from $92.1 billion in June. And wholesale inventories for July, adjusted for seasonal variations and trading-day differences, but not for price changes, were estimated at an end-of-month level of $603.2 billion, up 3.3% from July 2020.

In the second quarter, real gross domestic product (GDP) increased at an annual rate of 6.6%, according to the “second” estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 6.3%.

New orders for manufactured durable goods in July decreased $0.4 billion, or 0.1%, to $257.2 billion, according to the U.S. Census Bureau. This decrease, down following two consecutive monthly increases, followed a 0.8% June increase.

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) increased to +0.53 in July from –0.01 in June. Three of the four broad categories of indicators used to construct the index made positive contributions in July, and three categories improved from June. The index’s three-month moving average, CFNAI-MA3, moved up to +0.23 in July from +0.01 in June.

U.S. Manufacturing Technology Orders totaled $490 million in June, up 42% over June 2020, according to the U.S. Manufacturing Technology Orders report published by AMT – The Association For Manufacturing Technology. This total preceded pre-pandemic levels.

June sales of merchant wholesalers, except manufacturers’ sales branches and offices, after adjustment for seasonal variations and trading-day differences but not for price changes, were $588.1 billion, up 27.5% from the revised June 2020 level, according to the latest report from the U.S. Census Bureau.

The goods and services deficit was $75.7 billion in June, up $4.8 billion, or 6.7%, from $71 billion in May, revised, according to the U.S. Census Bureau and the U.S. Bureau of Economic Analysis. June exports were $207.7 billion, $1.2 billion more than May exports. June imports were $283.4 billion, $6 billion more than May imports.

The most recent TRENDS report from Heating, Air-conditioning & Refrigeration Distributors International (HARDI) showed the average sales performance by HARDI distributors increased 22.1% in June. The average annual sales growth for the 12 months through June 2021 was 17.2%, which was down slightly from the 17.6% record rate through May.

Construction spending during June was estimated at a seasonally adjusted annual rate of $1,5552.2 billion, 8.2% above the June 2020 estimate of $1,435 billion, according to the U.S. Census Bureau.

For more on distribution’s performance of late, read the results of the MDM-Baird quarterly survey from the July 25 issue of MDM Premium.

Related Posts

-

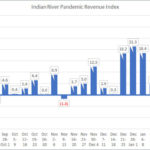

Indian River Consulting Group’s (IRCG) weekly Pandemic Revenue Index for the work week of Feb.…

-

ISM’s spring survey of purchasing and supply executives found that expectations are high for the…

-

Year-over-year, the goods and services deficit increased $4.8 billion, or 6.7%, from May.