When suppliers move to a direct sales model, distribution partners suffer. For large distributors, losing a key supplier can mean a reduction in product line, an increase in competition and a drop in both top and bottom lines. For small- and mid-sized distributors, losing a supplier can lead to extinction. However, distributors have retained a central place in the supply chain because the benefits to the supplier of going direct to all customers rarely justify the costs. Still, distributors recognize the continued threat of disintermediation. Smart organizations who understand the key issues underpinning this threat will position themselves best for future growth.

Suppliers have used a variety of methods to displace intermediaries: direct sales forces, company stores, vertical integration with owned distributors and online portals. Alternative strategies to selling through the distribution channel hinge on a few questions:

- Is the supplier’s required investment in infrastructure (e.g., distribution centers) justified by the marginal increases in revenue and margin?

- Can the supplier satisfy customers’ expectations for delivery and service?

- Can the supplier grow the share of its customers’ wallets by controlling the entire sales process?

What has changed?

Today’s buyers are increasingly more sophisticated and demanding. Large organizations frequently prefer to buy from partners that have: global presence, on-demand fulfilment capabilities, dedicated account teams (sales, support and technical service) and deep knowledge of their business and end customers.

Serving all customers remains an expensive proposition for suppliers, so many organizations incorporate trends to segment, size and prioritize buyers. Advanced segmentation models allow suppliers to partially disintermediate distributors by taking a nuanced rather than binary approach to coverage. The question has shifted away from, “Should we sell direct or indirect?” Organizations now ask, “What segments should we serve with a direct model?” or, “What sales process steps should we perform ourselves?”

Partial disintermediation allows suppliers to pick those buyers and activities that are most profitable and in line with their value propositions.

Suppliers are evolving the revenue generation organization (sales, marketing and service) to support direct-to-customer models. VPs of sales and marketing are investing to upgrade sales talent, adding features to productivity tools (e.g., business intelligence and CRM), increasing quality and availability of training, and strengthening value propositions to demonstrate value and become trusted advisers to buyers.

What are the risks?

These trends can significantly impact the growth prospects of distributors large and small. Consider some traditional distributor value propositions:

- Superior customer service

- Operational excellence

- Broad geographic reach

- Complete product line

These strengths guaranteed distributors a place in the supply chain because suppliers had neither the skills nor the appetite for the capital investment required to outperform distributors in these areas.

However, manufacturers rely on segmentation and technology to insert themselves into the areas of the value chain once dominated by wholesalers. Smart manufacturers realize that their end customers are far from homogeneous. Customers vary widely in terms of buying preference and behavior, wallet size, profitability, service demands and alignment with value messages.

Segmentation models provide manufacturers with answers to the question, “What types of customers (and how many) should we sell to directly?” At some point (based on potential volume, profitability and cost to serve), it makes economic sense to remove distributors from the equation. The danger to distributors is that manufacturers take the growth-oriented customers direct and leave distributors with the rest.

Technological advances have removed barriers to manufacturers servicing customers with a direct model. Advanced web portals, app-based ordering and telesales enable manufacturers to cover large geographies without building regional centers. Amazon.com has also become a delivery channel for manufacturers.

How can distributors continue to grow alongside manufacturers?

If the trend of partial disintermediation continues and more manufacturers consider selling direct to the most profitable segments, how can distributors expect to thrive? Most distributors fall into one of two camps:

- Those who treat growth as a zero-sum game. There is a finite amount of gross profit dollars out there, and we’ll fight our manufacturer partners to capture it.

- Those who consider growth a team sport. We can work with our manufacturers to figure out how we can help each other grow.

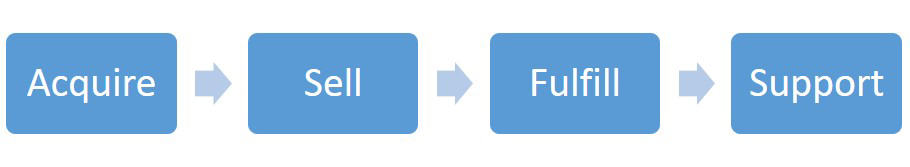

For those in the second category, growth can come through several strategies. Consider the following high-level sales process:

Manufacturers typically compensate distributors for performing activities across this process. Disintermediation impacts this model by allowing manufacturers to take on all steps for some customers — we run the play for our top accounts; you find other customers. or some steps for all customers — we find and convert customers; you fulfill it. In each instance, distributors have options to earn based on what value they provide in the process.

Manufacturer performs all steps for select customer set: As mentioned above, most manufacturers are unable to (or choose not to) cover large swaths of the market directly. A manufacturer might decide to explore a direct strategy for their top 10 accounts, many of which may be the distributor’s largest accounts. If customers are on board with this model (a big ‘if’ depending on the relationship with the distributor), the distributor has to make up a large amount of revenue and gross profit dollars elsewhere. The silver lining is that by drawing a line below the 10th largest account, the manufacturer has abdicated the rest of the market to the distributor.

Manufacturer performs some steps for all customers: Alternatively, a manufacturer might prefer to complete a certain step (e.g., acquisition) in-house. In this instance, manufacturers will likely reduce distributor pay because the distributor is performing fewer tasks.

A reduction in scope is not necessarily a bad thing. Some distributors find customer acquisition difficult and prefer to focus on fulfilment. If not asked to acquire customers, the distributor can reduce investment in lead generation and focus on operational excellence. However, there is a risk of being pigeonholed into a fulfilment arm, where the manufacturer’s sales team limits growth. To avoid “fulfilment prison,” distributors must prove that they can outperform manufacturers in value-added steps.

Distributors are well aware of the threats that partial or full disintermediation present. Smart organizations understand that there is enough opportunity in the market to thrive alongside manufacturers that pursue direct-to-customer models. Organizations should consider the following:

- The abilities of their manufacturing partners to serve customers directly;

- What their own customers value;

- How their own organization meets these customer needs.

Distributors who can answer these concerns will position themselves best for consistent profitable growth.

Andrew Horvath is a principal at the Alexander Group, a management consulting firm specializing in revenue growth. He leads the Distribution practice, monitoring trends and creating strategies to help growth-focused organizations stay on top of a rapidly changing market. For more information please visit alexandergoup.com.

This blog is No. 2 of MDM’s 10 Most-Read Blogs of 2019. Each week as the year winds down, we will share these most popular posts until we reach No. 1. View No. 3, 4, 5, 6, 7, 8, 9 and 10.

MDM wants to hear from you! Please comment below or email us at info@mdm.com.

Related Posts

-

Let the computer do some of the work by conducting a virtual pilot to sanity…

-

Flow-Zone is the premier distributor of pipe, valves, fittings, instrumentation, controls and measurement equipment for…

-

How manufacturers sell and how customers buy have undergone significant change in recent weeks, and…