The pandemic wake-up alarm went off in different ways for every business; some hit the snooze button, others jumped in a cold shower. Some leaders saw an opportunity in disruption for self-disruption to rethink and retool core go-to-market models. Others went into survival mode. Then everyone held on for dear life as the roller coaster bounce-back shot to the top of the arc. Life was good… for a while. But the turbulence of supply chain, inflation and talent pressures has most distribution teams stretched if not exhausted.

This year feels different, in spite of global and political volatility. I’ve had an opportunity to attend a few different roundtables over the past few weeks that have brought together executives from across every part of the distribution and manufacturing realms. And what I’m hearing validates a trend our research is surfacing. There’s a step change in how companies are looking at changing their business model — from minor tweaks to major transformation — to grow and create competitive advantage. Said another way, innovation attention and investment is getting more respect in 2024.

MDM’s upcoming SHIFT conference, to be held Sept. 11-13 in Denver, will address these different change management forces from a variety of angles, but more on that later.

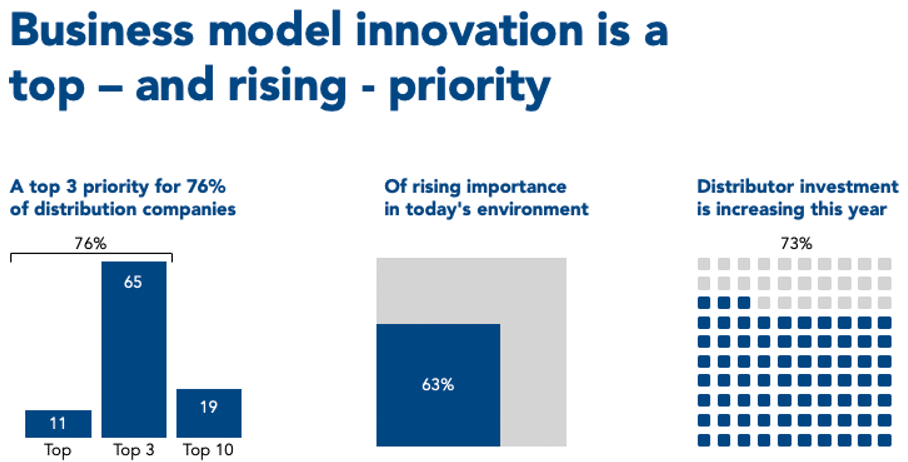

Our current research, led by Kevin Reid-Morris, who also led our AI research in 2023, identifies business model innovation as a top — and rising — priority for distribution leaders.

The findings triggered a few thoughts around what’s changing the mindset in spite of the instability of an election year and optimism for growth in the economic cycle keeps getting pushed back. Why now? To oversimplify, I think the answer is a combination of deferred technology investment and FOMO (Fear Of Missing Out). That’s true of any business cycle, but there’s something deeper going on here.

The New Amazon Effect: AI

As Amazon emerged in the early 2010s as a dominant eCommerce player, its perceived impact coined a term that described its threat and disruptive impact on retail initially, but a few years later the bullseye moved to distribution channels with the rise of Amazon Business. The “Amazon Effect” includes several key areas: elevating customer service expectations, price transparency, supply chain and logistics (i.e. Prime), and leveraging technology in innovative ways to disrupt traditional markets through an “endless aisle” and longtail product strategy.

I see a parallel between where the market is today and what the Amazon Effect induced a decade ago: an existential wake-up call on the threat-opportunity scale for every player across supply chain and distribution channels. In both cases, the unknowns and potential threats are high, driving attention, education and investment. In the case of Amazon, the focus was largely on eCommerce and digital development for revenue growth as well as customer acquisition and retention — elevating customer engagement and experience.

This time around, artificial intelligence reaches into every nook and cranny of the business, from the supplier’s supplier to the customer’s customer. That is daunting at this early stage of knowledge and adoption cycle. AI presents such a larger positive upside potential than the more defensive response to Amazon’s channel disruption across every dimension – operational efficiencies, talent, sales enablement, growth, competitive advantage and more. It also aligns with how we’ve formed the foundational pillars of our research and programming at MDM over the past several years. The reason has been that every distributor has engaged in some form of transformational work across the dimensions of sales process, digital, data analytics and culture.

Sales, Digital, Data Analytics & Culture: SHIFT Gears in 2024

These dimensions largely define how high-performance companies create competitive advantage and are the North Stars for MDM’s research, content and programming. They are the backbone for our September SHIFT Conference in Denver that combines workshops, case studies, peer panels and networking focused on these four dimensions.

Prior attendees have sent or brought their key leadership members to SHIFT to benchmark across the dimensions of sales, digital, data analytics and culture (during the conference’s opening session). During the conference, you’ll also hear what’s at the forefront of business model innovation in distribution with a keynote by McKinsey’s distribution team and sessions on hybrid sales, digital and data analytics. The agenda is available here. I hope you can join us.

We’re finalizing our speaker, case study and panel rosters, and I’ll be examining each of these business model innovation dimensions in this series.

Here are a few resources and our roadmap for reference:

- Research report: Business Model Innovation: Delighting Customers and Disrupting Competitors to Drive New Revenue

- Fastenal Case Study: The Big Pivot that Paid Big Dividends. This report examines Fastenal’s strategic pivots over the past ten years – digital, self-service, product mix, sales specialization and more — that have created one of the highest performing North American distributors as measured across most financial benchmarks.

- MDM Distribution Sales Summit: This free-to-attend virtual program on July 10 (and on-demand) is about the state-of-the-art in distribution sales process. This is a preview of our focus at SHIFT on the latest research and peer experience on hybrid sales models and technology leverage to sell smarter, better, faster.

Stay tuned for more in this blog series.

Related Posts

-

Time for a check-up on the state of the industry as 2023 ends. Mike Marks…

-

We preview MDM's May 2 webcast that will share results from our months-long study with…

-

Ricky Bortz will lead supplier programs, category development and category management teams to drive continued…